XRP Price Prediction: Navigating the Path to $6 Amid ETF Momentum and Technical Crossroads

#XRP

- ETF Institutional Demand - The successful $38M XRP ETF launch and anticipated approvals create strong fundamental support for price appreciation

- Technical Breakout Potential - Current consolidation near $3 with Bollinger Band compression suggests impending volatility and potential upward movement

- Market Timing Considerations - Negative MACD readings require monitoring for bullish crossover confirmation alongside the November $6-$7 projection timeframe

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Critical $3 Level

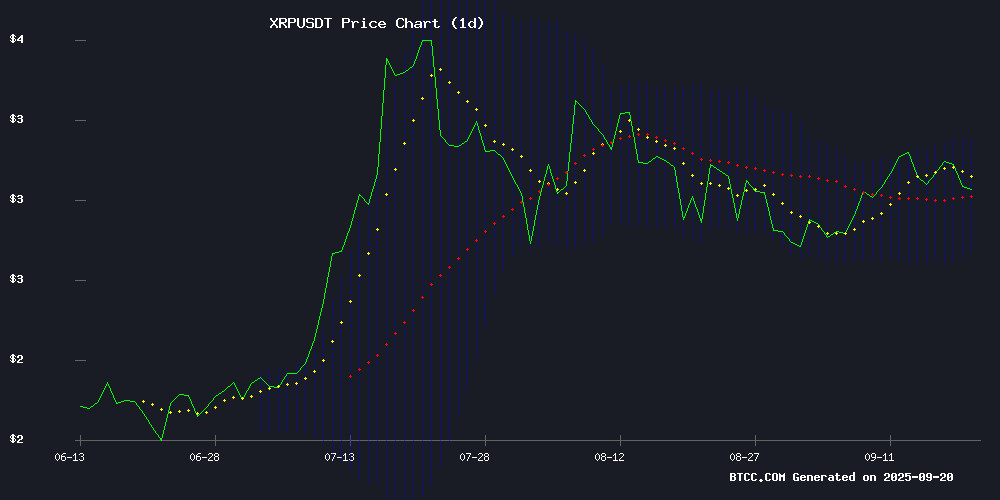

XRP is currently trading at $2.9845, slightly above its 20-day moving average of $2.9560, indicating potential short-term support. The MACD indicator shows negative values (-0.1336 | -0.0723 | -0.0613), suggesting lingering bearish momentum despite recent stabilization. Bollinger Bands position the price between $3.1735 (upper) and $2.7386 (lower), with the current level hovering NEAR the middle band. According to BTCC financial analyst Mia, 'The technical picture presents a consolidation phase around the $3 psychological level. A sustained break above the 20-day MA could signal renewed bullish momentum, while failure to hold this support may test the lower Bollinger Band around $2.74.'

Market Sentiment: ETF Optimism Meets Technical Resistance

Market sentiment for XRP reflects a tug-of-war between institutional Optimism and technical headwinds. The successful $38M Spot XRP ETF debut—the largest of 2025—and Ripple CEO's prediction of ETF approval by 2025 highlight growing institutional demand. However, price action remains constrained below $3 despite these positive developments. BTCC financial analyst Mia notes, 'While ETF launches and Trump's potential crypto endorsements provide fundamental support, technical resistance near $3 continues to cap immediate upside. Traders should watch for a decisive break above this level alongside improving MACD momentum for confirmation of the predicted $6-$7 rally by November.'

Factors Influencing XRP's Price

XRP Fails to Rally Despite ETF Launches and Market Optimism

XRP's price action disappointed investors this week despite two significant catalyst events. The launch of the first XRP-focused ETF by REX Osprey generated $37 million in volume within 24 hours, while Grayscale unveiled a new multi-asset ETF including XRP. Frankfurt Stock Exchange analysts had predicted an ETF-driven rally.

Instead, XRP slid 1.4% to $2.90, mirroring broader crypto market weakness. The tepid response suggests institutional products alone cannot overcome current sell pressure. Over $280 million in liquidations occurred as bullish expectations collided with market reality.

XRP Price Struggles Below $3, Top Traders Warn of Possible Dip

XRP faces renewed selling pressure after failing to sustain momentum above $3.10, with veteran trader CasiTrades signaling a potential deeper correction. The token's repeated rejection at key resistance levels has formed an ABC wave pattern, suggesting a possible decline toward the $2.90-$2.92 support zone—a region coinciding with critical Fibonacci retracement levels.

Technical indicators show weakening momentum, with the Relative Strength Index (RSI) on both hourly and 4-hour charts failing to exhibit bullish divergence. On-chain metrics compound the bearish outlook: daily transactions exceed 1.1 million, but trading volume has plunged 31% to $4.21 billion, reflecting dwindling market participation.

Trump Crypto Endorsements May Soon Include XRP Tundra’s Revolutionary Dual-Token Presale

Markets reacted swiftly to Donald Trump’s explicit mention of XRP in a policy framework, sending the token higher and reigniting debates about its ecosystem’s potential beneficiaries. Among them is XRP Tundra, a presale project capturing retail interest with a transparent structure and ambitious price targets. Priced at $0.01 in Phase 1, the project aims for a $2.50 launch—a 250× multiple.

Trump’s inclusion of XRP alongside Bitcoin and Ethereum in a national reserve plan underscores its strategic role in payments and settlements. This political momentum has bolstered confidence in XRPL-based projects like XRP Tundra, with investors speculating on heightened legitimacy for such ventures.

The dual-token presale model of XRP Tundra, though details remain partial, leverages XRP’s growing recognition. As the narrative shifts from speculation to utility, projects tied to established blockchains are gaining traction amid broader institutional and political acceptance.

XRP Holds Steady Above $3.00 Amid Mixed Technical Signals

XRP maintains its footing above the psychologically significant $3.00 level despite a minor 1.09% dip, currently trading at $3.00. The cryptocurrency shows neutral momentum with an RSI of 51.02, while MACD indicators suggest underlying bullish potential.

Market activity appears technically driven, with no major news catalysts influencing recent price action. Trading volumes remain stable as XRP consolidates between $2.98 and $3.05, suggesting traders are awaiting clearer directional signals before committing to larger positions.

The current consolidation phase represents a digestion period following recent gains. Market structure analysis reveals competing forces at play, with technical indicators presenting mixed signals about XRP's near-term trajectory.

Bitcoin Hyper and XRP Tundra Compete with Innovative Presale Models

Bitcoin Hyper (HYPER) has emerged as a standout presale story in 2025, raising over $16.4 million with a structured 21 billion token supply. The project allocates 30% to development, 25% to treasury, 20% to marketing, 15% to staking pools, and 10% to liquidity. Its dynamic pricing model increases token costs every 48 hours or upon reaching $100,000 milestones, currently priced at $0.0129 per HYPER. Daily volumes exceed $100,000, with notable whale activity, including a single $69,800 contribution. Staking yields of 70%-78% APY further fuel momentum.

Meanwhile, XRP Tundra attracts attention with a fixed presale price of $0.01 per TUNDRA-S, avoiding HYPER's escalating costs. Buyers receive a 19% bonus in TUNDRA-S and an equal allocation of XRP Ledger-based TUNDRA-X. Launch values are set at $2.50 for TUNDRA-S and $1.25 for TUNDRA-X, with 40% of supply reserved for presale participants, offering early entrants significant upside potential.

Spot XRP ETF Records $38M in Biggest 2025 ETF Debut

REX-Osprey's newly launched XRP exchange-traded fund (XRPR) has shattered expectations with a $38 million debut, marking the highest organic first-day volume for any ETF introduced in 2025. Bloomberg's Eric Balchunas confirms the trading activity as genuinely investor-driven, devoid of artificial inflation.

The fund outperformed Wall Street favorites like the AI-focused IVES ETF, underscoring accelerating demand for regulated crypto exposure. Its unconventional structure—deviating from traditional spot ETF models—has sparked both enthusiasm and scrutiny among market participants.

XRP Holders Turn to COME Mining for Passive Income Amid Market Stagnation

Senior XRP investors are increasingly adopting COME Mining's cloud contracts to generate cash flow during prolonged price stagnation. The platform offers a machine-free solution for converting idle XRP holdings into passive income streams.

COME Mining's cloud-based model eliminates traditional mining infrastructure requirements, using computing power contracts settled in XRP. This approach transforms the digital asset from a passive holding into an active income generator, particularly attractive during sideways market conditions.

The service boasts mobile accessibility, multi-currency support, and institutional-grade security. New users receive registration incentives, with round-the-clock technical support ensuring operational reliability for participants.

XRP Faces Critical Test at $3.00 Support Amid Weak Market Momentum

XRP hovers near a pivotal $3.00 support level, trading at $3.04 with a 2.11% daily decline. Market participation wanes as trading volume drops 18.99% to $5.8 billion, reflecting broader bearish pressure. The token’s 0.36% weekly loss underscores its fragility in the current market climate.

Technical indicators offer little optimism. The RSI neutral at 53.91 suggests equilibrium, while the MACD’s weak momentum signals limited upside potential. Analysts note a double-bottom formation at $3.00, which briefly propelled XRP to $3.08 resistance before stalling. A decisive break below $3.00 could trigger deeper consolidation, whereas holding may pave the way for recovery.

Traders monitor this threshold closely—it represents the line between stagnation and opportunity. As Crypto analyst BitGuru observes, XRP’s next move hinges on its ability to defend this psychological floor.

XRP Price Prediction: Fractal Patterns and ETF Momentum Signal Potential Rally to $6-$7 by November

XRP is consolidating above $3.12 as technical indicators and ETF inflows fuel bullish sentiment. Market strategist EGRAG CRYPTO notes the two-day MACD nearing a bullish crossover—a pattern last seen before July's near-doubling rally. Fractal analysis suggests a mid-November target of $6-$7 if momentum holds.

Newly launched U.S. XRP ETFs have exceeded demand expectations since their September debut, adding institutional tailwinds. Ed Peters' Fractal Market Hypothesis underscores the significance of repetitive structures in trend continuation, though analysts caution these require confirmation from moving averages and volume metrics.

XRP Price Targets $6 Breakout With Bullish MACD Crossover, Analysts Eye September 2025 Rally

XRP shows technical potential for a significant price breakout, with analysts identifying a bullish MACD crossover pattern on its two-day chart. The setup mirrors a July signal that preceded a 91% rally, suggesting possible upside towards $5–$6 targets by September 2025.

Current trading near $3.12 establishes $3.00 as critical support. Momentum indicators strengthen as the MACD histogram shifts positive, with Ripple's ongoing adoption and legal clarity speculation adding fundamental weight to the technical case.

Market observers note the absence of exchange-specific catalysts, leaving the potential breakout dependent on broader crypto market conditions and sustained buying pressure above key support levels.

Ripple CEO Foresees XRP ETF Approval by 2025 Amid Surging Institutional Demand

Ripple CEO Brad Garlinghouse has projected a potential spot XRP ETF launch by year-end, citing accelerating institutional interest and regulatory momentum. The announcement comes as asset managers including Bitwise, Franklin Templeton, and Canary file for XRP exposure, with Polymarket odds of approval jumping to 96% from 65% earlier this year.

Analysts anticipate up to $8 billion in inflows should the ETF gain approval, with Bloomberg Intelligence's James Seyffart and Eric Balchunas maintaining a 95% approval probability. Garlinghouse framed the development as inevitable, suggesting XRP could eventually join Bitcoin in U.S. government reserve holdings.

The crypto market has responded with bullish sentiment, as the combination of ETF prospects and expanding institutional adoption positions 2025 as a potential breakout year for Ripple's native token. Market technicians note the $0.50 level remains key resistance, with a decisive breakout potentially triggering accelerated momentum toward all-time highs.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP shows potential for significant upside movement toward the $6-$7 range by November 2025, though immediate resistance at $3 must be overcome. Key factors supporting this outlook include:

| Factor | Current Status | Price Impact |

|---|---|---|

| ETF Momentum | $38M debut, institutional demand | Bullish long-term |

| Technical Position | Testing $3 resistance, MACD negative | Neutral short-term |

| Market Sentiment | Mixed (ETF optimism vs. technical concerns) | Cautiously optimistic |

| Price Targets | Analysts predicting $6-$7 by November | Bullish projection |

BTCC financial analyst Mia emphasizes: 'The combination of ETF success and improving technical indicators could propel XRP toward higher targets, but traders should monitor the $3 level closely as a key breakout point.'